Welcome to Marlau Investments

A Privately Held Real Estate Investment Company

Extensive Experience

Innovative Strategies

Local Market Knowledge

Marlau Investments is a privately held residential real estate investment firm that has continually generated high returns throughout all market conditions to become one of the leading residential investment firms in the greater DFW Metroplex.

We are Selective

We are real estate investors who employ a straightforward time-proven strategy. We selectively acquire high-quality residential properties that are located in desirable neighborhoods that are purchased at a substantial discount. Many of the properties we acquire need extensive rehabilitation and the proceeds from the sale help the sellers overcome financial stress.

Who We Are

Marlau Investments is a privately held residential real estate investment company with offices in Dallas, Texas. Our team is comprised of real estate professionals with over 35+ years of experience.

How We’re Different

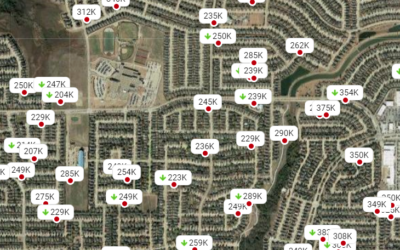

We use investment strategies that capitalize on market trends to enhance returns and limit downside risks. We make buy, hold, flip, and sell decisions based upon careful analysis of where the market is trending.

What We Invest In

We review hundreds of deals every year but only the most promising properties are added to our portfolio. We select amongst the best moderately priced homes located in established communities that will provide steady positive income.

What you need to know

Know When to Buy

We will purchase many homes but only a select few will meet our stringent criteria and be added to our long-term rental portfolio. The remaining homes are renovated, marketed, and resold to individuals and other investors.

Know When to Sell

We constantly monitor the local and national real estate market to identify current and trending indicators. Once market trends indicate the market has peaked (or near the peak) we lock in profits by selling the homes in our portfolio.

Know When to Hold

We unlock value by renovating, upgrading, and addressing any major mechanical issues. We then market, manage, and maintain the asset as a rental property to generate positive income and long-term capital appreciation.

Know When to Flip

During market-down trends, we do not add to our portfolio but concentrate on the fix and flip opportunities. This generates immediate cash flow while limiting downside risk.

News and Blogs

Quick Tips for Novice RE Investors

Where to Start? If you have yet to take the plunge into real estate investing, get ready for a wild ride. It’s a fast-paced industry with many...

What is the difference between list and sales prices?

The list price is the current asking price the home is advertised for and is typically the price a seller would like to get for the property. The...

How is the price set?

The real estate market is continually changing, and since these market fluctuations have an effect on property values it is imperative to price the...